In today’s fast-moving world, parenting isn’t just about love and sacrifice. There’s something else just as important being financially ready.

With education costs rising every year, shifting lifestyles, and growing family needs, modern parents need more than good intentions. They need the right financial know-how to prepare and secure their children’s future.

But the reality? Many families still don’t have a clear financial plan especially for long-term goals like education or emergency savings. Often, money decisions are made out of habit or social pressure, not careful planning.

The Real Challenge: Financial Readiness

Recent surveys reveal a concerning fact: more than 60% of parents in Indonesia haven’t started saving for their children’s education. And while education costs keep climbing, financial planning often falls behind.

The issue isn’t always about income it’s about access to the right financial education. Without the right tools and knowledge, families may face financial stress down the line, which could affect both their stability and their children’s opportunities.

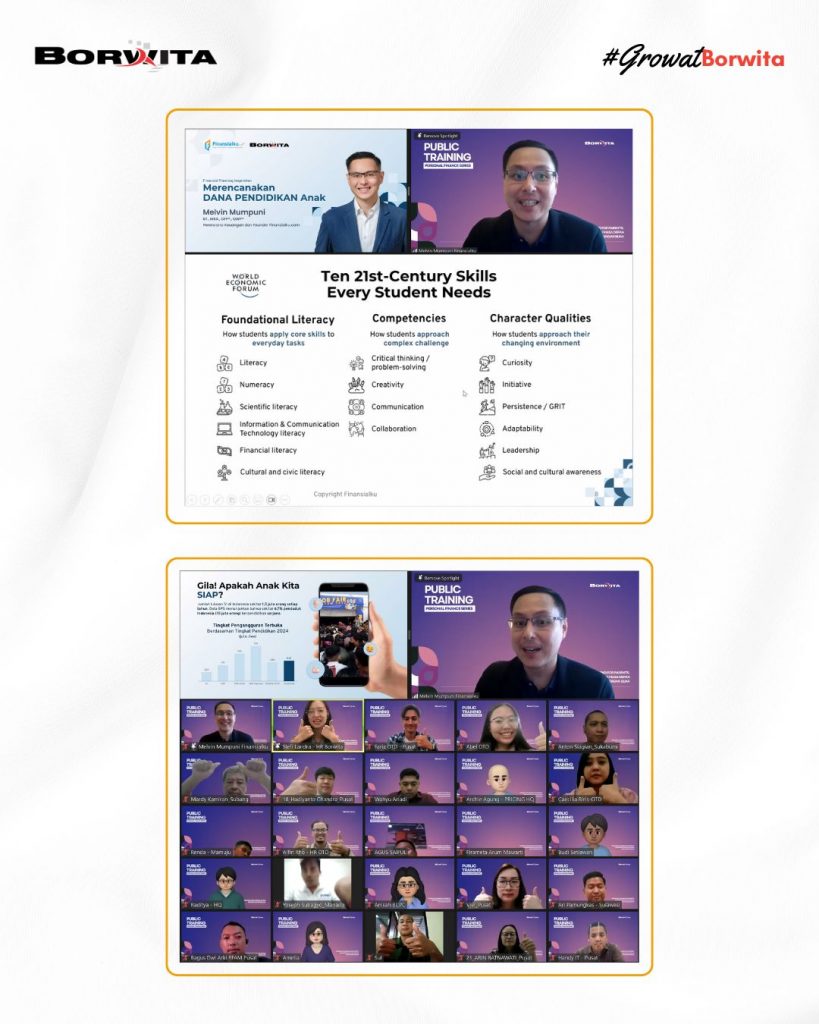

Seeing how important this issue is, Borwita Citra Prima, one of Indonesia’s leading FMCG distributors, launched a special session called:

Parenting Finance Series: Preparing for Your Child’s Future, Wisely

Part of Borwita’s ongoing Public Training Program, this session was designed to support employee well-being both at work and at home. Featuring a trusted financial planning expert, the session offered real, practical advice on topics like:

- Setting the right financial priorities for your family

- How to manage education funds smartly

- Building healthy investment habits early on

- Budgeting pitfalls and how to avoid them

What made this session special was its interactive format. Instead of just a one-way talk, it involved real-life case studies, open discussion, and a safe space for employees to ask personal financial questions.

The feedback? Overwhelmingly positive. Many participants said the session gave them clarity, encouragement, and a solid starting point to begin planning their children’s financial future.

This initiative shows Borwita’s deep care for its people not just as professionals, but also as parents and decision-makers.

With operations across the nation, Borwita continues to foster a culture that balances high performance with real care for people.

Because Borwita believes long-term success begins with employees who are healthy, happy, and empowered. Programs like the Parenting Finance Series are a reflection of that belief because a better future always starts at home.