In today’s world, earning an income alone is not enough to ensure long-term financial stability. Without proper financial planning, individuals can easily fall into cycles of debt, impulsive spending, and unpreparedness for unexpected expenses.

According to Prudential, personal finance includes managing income, expenses, savings, investments, and protection—allowing people to make wise financial decisions that help them achieve life goals.

For example, low financial literacy often becomes a major barrier preventing people from starting to invest or choosing the right financial instruments. A study from Jurnal Bisnis Lombok found that good financial literacy helps individuals manage debt wisely, save consistently, and make sound investment decisions—ultimately leading to long-term financial stability.

(Source: jurnal.bisnislombok.ac.id)

In Indonesia, the Financial Services Authority (OJK) and various financial institutions continue to promote financial literacy and inclusion so that more people can gain access to safe and suitable financial products that match their risk profiles.

With a strong foundation in personal finance management, investment becomes the next important step—helping individuals grow their assets, beat inflation, and achieve their financial goals.

Basic Investment Principles for Beginners

Before diving into Borwita’s public training theme, here are several key investment principles worth keeping in mind:

1. Fight inflation and preserve the value of money

Money that is only saved (not invested) will lose value over time due to inflation. Investment helps maintain or even grow that value.

2. Match investment instruments with your risk profile and time horizon

For beginners, relatively safe and accessible instruments—such as money market or fixed income mutual funds—can be a good starting point.

Understand the liquidity (how quickly your funds can be withdrawn if needed) and legality of your chosen products. Make sure they are supervised by OJK or other trusted institutions.

3. Consistency matters more than large sums

You don’t need a big salary to start investing. Small but consistent contributions can make a significant impact over time.

4. Diversify and manage risks

Never “put all your eggs in one basket.” Spread your investments across multiple instruments to minimize potential losses.

5. Define your financial goals first

Whether it’s for an emergency fund, children’s education, retirement, or buying a home—your goals will determine the right instruments, time frame, and investment strategy.

Borwita Public Training: Start Investing Now—A Beginner’s Guide to Building Assets

On Saturday, September 13, 2025, Borwita held a public training session titled “Start Investing Now: A Beginner’s Guide to Building Assets.”

The event was designed for beginners who wish to start their investment journey with strong foundational knowledge and a clear sense of direction.

The keynote speaker was Melvin Mumpuni, CEO & Founder of Finansialku, a well-known financial planner and educator in Indonesia. He shared practical and actionable insights, especially for employees taking their first steps into investing.

Key Topics Covered

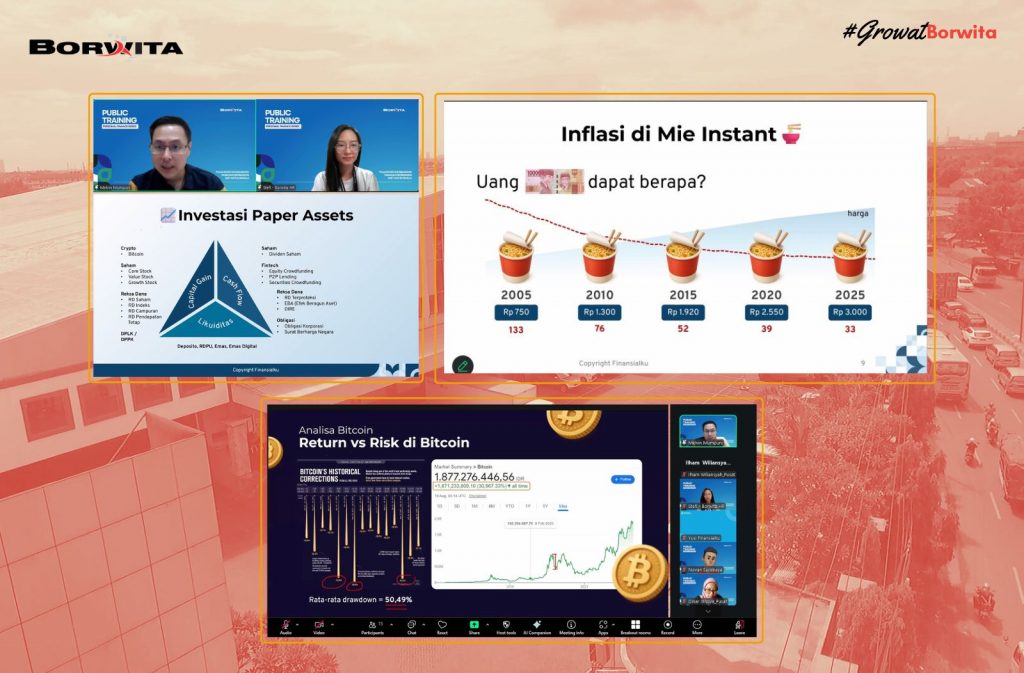

1. Investment as a Tool to Beat Inflation and Achieve Financial Goals

Melvin emphasized that investing is not merely about chasing high returns—it’s about preserving purchasing power and preparing for future needs, such as buying a home or funding education.

2. Safe, Affordable, and Beginner-Friendly Investment Instruments

Participants were introduced to several options they could explore:

- Mutual funds (money market, fixed income)

- Corporate or government bonds

- Gold or other precious metal instruments

- Capital market instruments with moderate risk profiles

Melvin reminded everyone that “safe” doesn’t mean “risk-free.” The key is finding what suits one’s understanding and risk tolerance.

3. The Power of Consistent Investing

One of the most crucial takeaways: successful investing isn’t about how much you invest, but how regularly you do it.

Melvin encouraged participants to start now—no matter their salary level—and stay committed over time.

4. Practical Tips and Hands-On Insights

Participants also learned how to diversify their portfolios, identify ideal entry or exit times, and monitor their investment performance effectively.

Benefits for Borwita Employees

The webinar received positive feedback from Borwita employees. They gained valuable takeaways such as:

- A clearer, structured understanding of the investment world

- First-hand learning from an experienced financial practitioner

- The ability to recognize and avoid high-risk or misleading investment offers

- A long-term mindset: investing is not a “get-rich-quick” scheme but a deliberate, goal-driven process

Starting early allows employees to build productive assets and strengthen their financial stability for the future. However, without proper understanding, the risks can easily outweigh the rewards.

Borwita’s event, “Start Investing Now: A Beginner’s Guide to Building Assets,” featuring Melvin Mumpuni, marks an important step toward improving employees’ financial literacy—empowering them to make wiser, more sustainable financial decisions.